Stock markets have long moved to their own drummer, responding to forces that are sometimes quite different than what we expect. For investors, the key to success is to figure out just what force – or combination of forces – is going to impact the markets next.

In a recent report from the UK-based Chatham House think tank, economy and finance program director Creon Butler points to climate change as the next market game-changer. In fact, Butler sees climate issues causing a sharp market correction within 5 years.

Butler points out some of the potential fallout risks of a rapidly warming climate, and their influence on markets. His list of risks includes the emergence of new diseases, alterations in crop cycles reducing food supplies, tighter government regulation on carbon emissions, and a real estate pull-back from coastal areas. That last point, on property, is already impacting California, where several major home insurers have stopped writing property policies due to an increased risk from natural disasters.

“Whatever the reasons for the markets’ current equanimity on climate risks, a sharp adjustment looks increasingly probable. The longer it is delayed, the sharper it is likely to be – and the more potential triggers emerge,” Butler summed up.

But it’s not all doom and gloom – some stocks will thrive in this new climate-change era. We’ve used the TipRanks database to pinpoint two names that will play a crucial role in shaping the emerging ‘green’ economy. Let’s check the details.

Brookfield Renewable Partners (BEP)

First up, Brookfield Renewable, an owner and operator of renewable power assets. The company owns a diverse portfolio of energy assets around the world, including distributed energy and sustainable solutions as well as wind, solar, and hydroelectric power generation facilities.

Brookfield is under 60% ownership of Brookfield Asset Management, one of Canada’s largest alternative investment management firms. This gives the partnership energy firm solid financial backing, which it has used to build up its capabilities in utility-grade power generation installations. To date, Brookfield Renewable Partners has a power development pipeline, in renewable energy projects, totaling 126,000 megawatts. Some 5,000 megawatts of that capacity is on track for commissioning this year.

This partnership firm will release its 2Q23 earnings on Friday (August 4), but in the meantime it’s helpful to look back at the Q1 results for a snapshot of where the company stood earlier this year. The top line in Q1 came to $1.33 billion, up 17% year-over-year and coming in $54.8 million ahead of the forecasts. BEP had a funds from operations (FFO, a key metric in partnership companies) of 43 cents per share, for a 13% y/y increase.

Also important, Brookfield Renewable Partners increased its cash holdings in Q1, to $1.14 billion from $998 million at the end of December. This represented a 14% gain quarter-over-quarter.

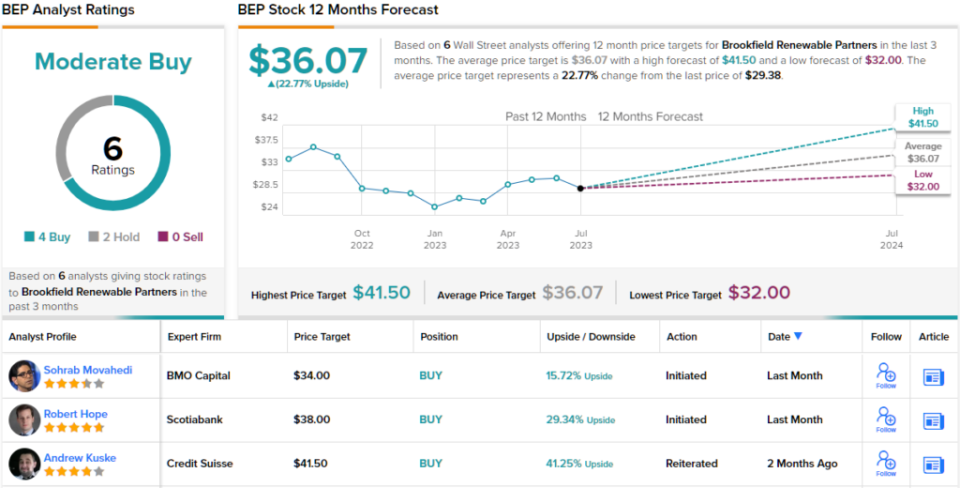

Scotiabank analyst Robert Hope is impressed by what he sees in this firm, especially in the risk/reward profile of its portfolio expansion and the firm’s solid cash/liquidity position. Hope writes, “We see BEP as having one of the stronger growth profiles in our coverage universe with 13% / 12% FFOPU growth in 2023E / 2024E. It is also impressive to us that the company is able to generate this growth with limited single-project construction risk and while maintaining strong liquidity. We view Brookfield Renewable as a high-quality and high-growth way to participate in the global renewable power and decarbonization theme…”

Looking forward, Hope gives BEP an Outperform (i.e. Buy) rating with a $38 price target, suggesting a 29% upside for the year ahead. (To watch Hope’s track record, click here)

This renewable energy firm gets a Moderate Buy rating from the consensus of the Street’s analysts, based on 6 recent analyst reviews that include 4 Buys and 2 Holds. The stock is selling for $29.38 and has an average target price of $36.07, implying a one-year upside potential of ~23%. (See BEP stock forecast)

Sunrun, Inc. (RUN)

Next up on our list is Sunrun, a leading firm in the residential solar power niche. Sunrun designs, builds, and installs a range of home-based solar power installations, offering customers package deals designed-to-order for each individual home. The packages include everything needed to fit the installation to the particular location and power needs, including rooftop photovoltaic panels, power storage batteries, and smart control systems, as well as connections to the local electric power grid.

Sunrun doesn’t stop with solar power home installations, though. The company also offers financing options, allowing customers to choose to pay in full up front or to amortize the cost as a lease, on a long-term or month-to-month basis. Customers can also take loans with Sunrun, to facilitate the purchase. Through the end of Q1 this year, Sunrun could boast of 700,000 customers, in 22 states as well as DC and Puerto Rico.

Interest in solar power has been growing in recent years, supported by both governmental and societal pushes to promote clean power. This helped push Sunrun to more than 30% sales activity growth in the last quarter reported, 1Q23. The company’s highest growth region was California, which has both a strong legislative push to promote solar power as well as a favorably sunny climate; Sunrun saw 80% sales growth in California in Q1. Looking ahead, Sunrun can feel secure – its has $1.1 billion in annual recurring revenue, and the average contract life remaining is 17.6 years.

Getting to the brass tacks, we find that Sunrun reported a total of 240 installed megawatts in Q1, generating $589.9 million in revenue, for 19% y/y top line growth, and beating the forecast by more than $72 million. The company’s EPS was a net loss, of $1.12 per share, and missed the expectations, coming in 97 cents per share below estimates. We’ll see Sunrun’s Q2 results next week (Wednesday, August 2).

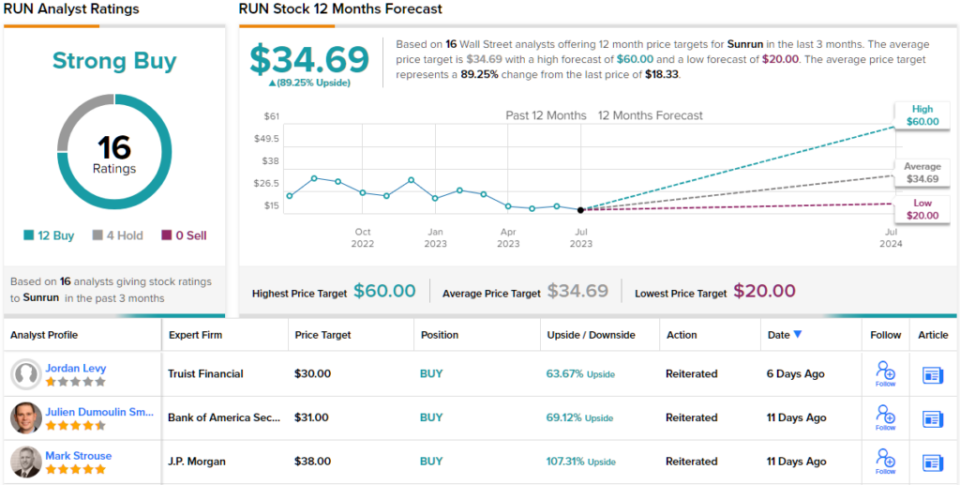

Despite the earnings miss, the strong sales growth and revenue beat along with a leading position in an ‘underpenetrated’ market got this stock notice from Mark Strouse, 5-star analyst with JPMorgan. Strouse writes of Sunrun, “RUN is a leader in residential energy services including solar, storage, EV charging, home energy management, etc., an underpenetrated market that we expect to grow at a double-digit CAGR for the foreseeable future. The company has strong visibility into future revenue owing to long-term customer contracts, value per customer should improve as more services are adopted, and we believe RUN is positioned for market share gains owing to favorable ITC rules as well as the company’s leading scale.”

Strouse follows up his comments with an Overweight (i.e. Buy) rating for the stock, plus a $38 price target that underscores his confidence in a 107% upside on the 12-month horizon. (To watch Strouse’s track record, click here)

Overall, there are 16 recent analyst reviews for RUN shares, breaking down 12 to 4 in favor of Buys over Holds, for a Strong Buy consensus rating. The stock is trading for $18.33 and has an average price target of $34.69, implying that a gain of 89% is in store for the coming year. (See Sunrun stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

#Potential #climate #disaster #hit #stock #market #economist #warns #stocks #fight #greener #future