Hiring in the US probably increased at a healthy yet more moderate clip this month, representing a vote of confidence about the demand outlook after a solid first half of the year.

![6k)kjafyy{ls2ffee]k]{9o[_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/07/central-bank-rate-decisions-this-week.jpg?quality=90&strip=all&w=288&h=216&sig=COaPNNsTHmZ5dClHF9X5tA)

Article content

(Bloomberg) — Hiring in the US probably increased at a healthy yet more moderate clip this month, representing a vote of confidence about the demand outlook after a solid first half of the year.

Advertisement 2

Article content

The closely watched jobs report on Friday is projected to show employers boosted payrolls by 200,000 in July, while unemployment held at a historically low 3.6% and hourly pay cooled. Earlier in the week, separate data are seen showing fewer June job openings that indicate better balance in the labor market.

Article content

The employment report comes on the heels of a surprising acceleration in second-quarter economic growth. While recession risks remain, so far the US economy has proved resilient in stark contrast to the weakness gripping greater Europe and the sluggishness in China.

To that point: Federal Reserve Chair Jerome Powell, after the US central bank boosted rates by a quarter point this week, said Fed economists are no longer forecasting a recession in 2023. Christine Lagarde, head of the European Central Bank, said the outlook for Europe has “deteriorated.”

Advertisement 3

Article content

What Bloomberg Economics Says:

“We’re not in the camp expecting a soft landing — which the Fed has achieved only once in the past half century. The disinflation seen in recent data doesn’t reflect the death of the Phillips Curve or an anomalous break between net demand and prices. Rather, it’s because there are real cracks in the economy. Long after supply chains have normalized, it’s a downdraft in demand that’s driving the current wave of disinflation.”

—Anna Wong, Stuart Paul and Jonathan Church. For full analysis, click here

The steadfast labor market has been a key fuel source for the economy as the Fed kept tightening monetary policy to contain inflation. The government’s June job openings data on Tuesday are projected to show the fifth decline in six months, consistent with some softening in labor-market conditions that will help restrain price pressures.

Article content

Advertisement 4

Article content

- For more, read Bloomberg Economics’ full Week Ahead for the US

Among other US economic data this coming week are Institute for Supply Management purchasing managers surveys at manufacturers and service providers. On Monday, the Fed will issue its senior loan officer survey that will help gauge the credit fallout from the central bank’s rate hikes.

Looking north, Canadian labor data will also be released, with an increase of 25,000 jobs expected for July that would likely ease pressure for more rate hikes.

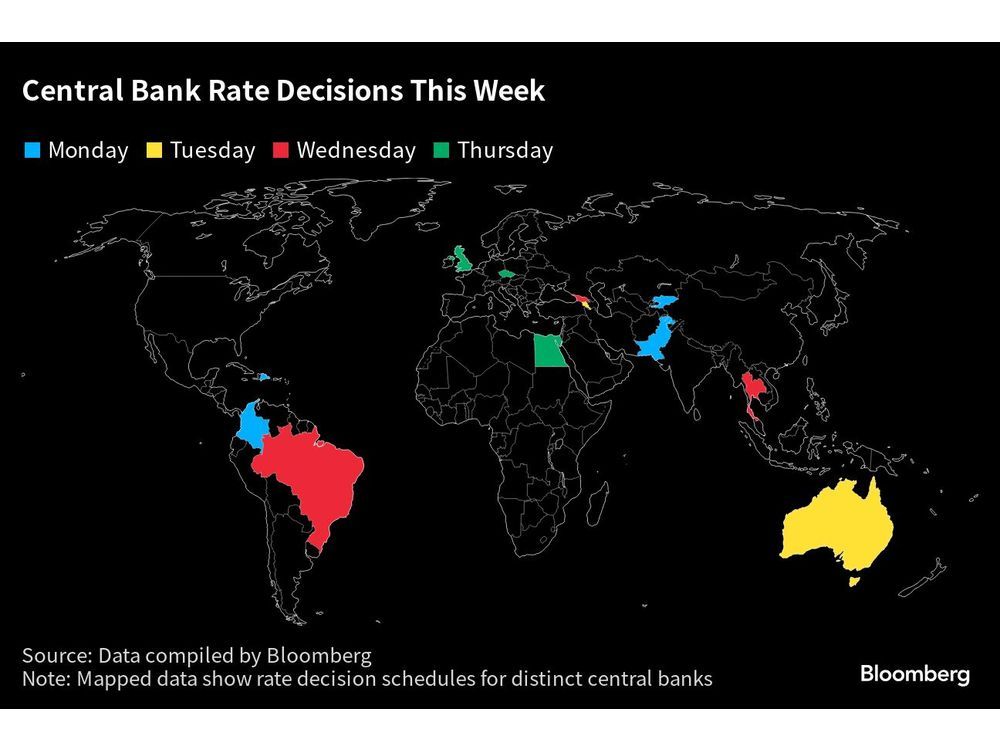

Elsewhere, suspenseful decisions on possible rate hikes in the UK and Australia, along with a potential cut from Brazil’s central bank, and euro-zone inflation data will be among the highlights for investors.

Advertisement 5

Article content

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

Investors are likely to focus on China’s PMI figures at the start of the week to gauge the state of the world’s second largest economy, while a slew of other purchasing managers data from the region will give a broader sense of the state of play.

The Reserve Bank of Australia is set for a close-call rate decision on Tuesday as softer-than-expected inflation clashes with a solid labor market.

Pakistan and Thailand’s central banks will also be making their rate calls next week.

In Japan, production and retail sales data out Monday will feed into views on second-quarter economic growth.

Inflation figures during the week from Indonesia, South Korea and the Philippines should give the latest insight into the state of price growth slowdown in the region.

Advertisement 6

Article content

South Korea’s trade data on Tuesday is likely to reflect a further slowdown in global demand.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The Bank of England will take the spotlight in the region this week as policymakers decide whether to raise rates by a quarter-point, or to drive through an even bigger half point increase, given the stubbornness of UK inflation.

That latter outcome on Thursday is predicted by a minority of economists.

Whatever happens, it’s less likely that officials will be as sanguine as peers in the US and euro zone and raise the prospect that tightening could be finished.

Euro-region inflation is slower than in the UK, but it’s still too fast for the ECB. Consumer prices rose an annual 5.3% in July, according to economists forecasts.

Advertisement 7

Article content

Their estimates suggest an underlying gauge stripping out volatile elements such as energy exceeded that measure for the first time since early 2021. reaching 5.4%.

Those data will be released on Monday alongside gross domestic product numbers that may show the euro zone returned to growth in the second quarter, as an unexpectedly buoyant French economy made up for stagnation in Germany.

German factory orders, and industrial production data in France, Italy and Spain, will all be released on Friday, further illustrating how manufacturing fared in June.

In Switzerland, inflation is below the 2% ceiling targeted by policymakers, but they still worry it may return with a vengeance later this year. The latest price data there will be released on Thursday.

Advertisement 8

Article content

Further east, the Czech central bank may keep its rate unchanged at 7% the same day.

Turning to the African continent, Kenyan data on Monday will likely show inflation edged closer to the ceiling of the central bank’s 2.5% to 7.5% target band. That may ease pressure for a rate hike on Aug. 9, after officials raised borrowing costs by 100 basis points last month.

While Egypt’s inflation accelerated to a record last month, the central bank isn’t expected to resume monetary tightening on Thursday as it builds enough foreign-currency buffers to manage another currency devaluation.

Over in Turkey the same day, analysts expect July data to show inflation quickened to 46% in July. Last week, the central bank governor said it will probably reach almost 60% by the end of the year.

Advertisement 9

Article content

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Brazil’s central bank is the main event in the region this week, with policymakers widely expected to kick off an easing cycle after keeping the key rate unchanged at 13.75% since last August.

Analysts and traders see a half-point reduction to 13.25% on Wednesday. For 2023 overall, analysts see 12.25% at year-end while the markets are pricing in 11.5%.

Mexico starts the week with its flash second-quarter output reading that’s expected to show a marginal slowdown. Economists surveyed by Bloomberg now see Mexico outpacing major regional peers in 2023.

Chile — which just cut rates — posts six separate June indicators including economic activity, retail sales, industrial production and copper output. The economy probably contracted in the second quarter and may do little more than tread water in 2023.

In Peru, the July Lima consumer prices report will likely show a sixth month of disinflation after tumbling from 7.89% in May to 6.46% in June.

In Colombia, a busy week is on tap for Banco de la Republica: It’s all but certain to keep the key rate at 13.25% for a second meeting, before posting its quarterly monetary policy report followed by the minutes of the decision on Thursday.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

—With assistance from Robert Jameson, Monique Vanek, Paul Wallace and Paul Jackson.

Article content

#Economy #Set #Show #Resilience #Jobs #Data

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation