You can listen to this podcast on iono.fm here.

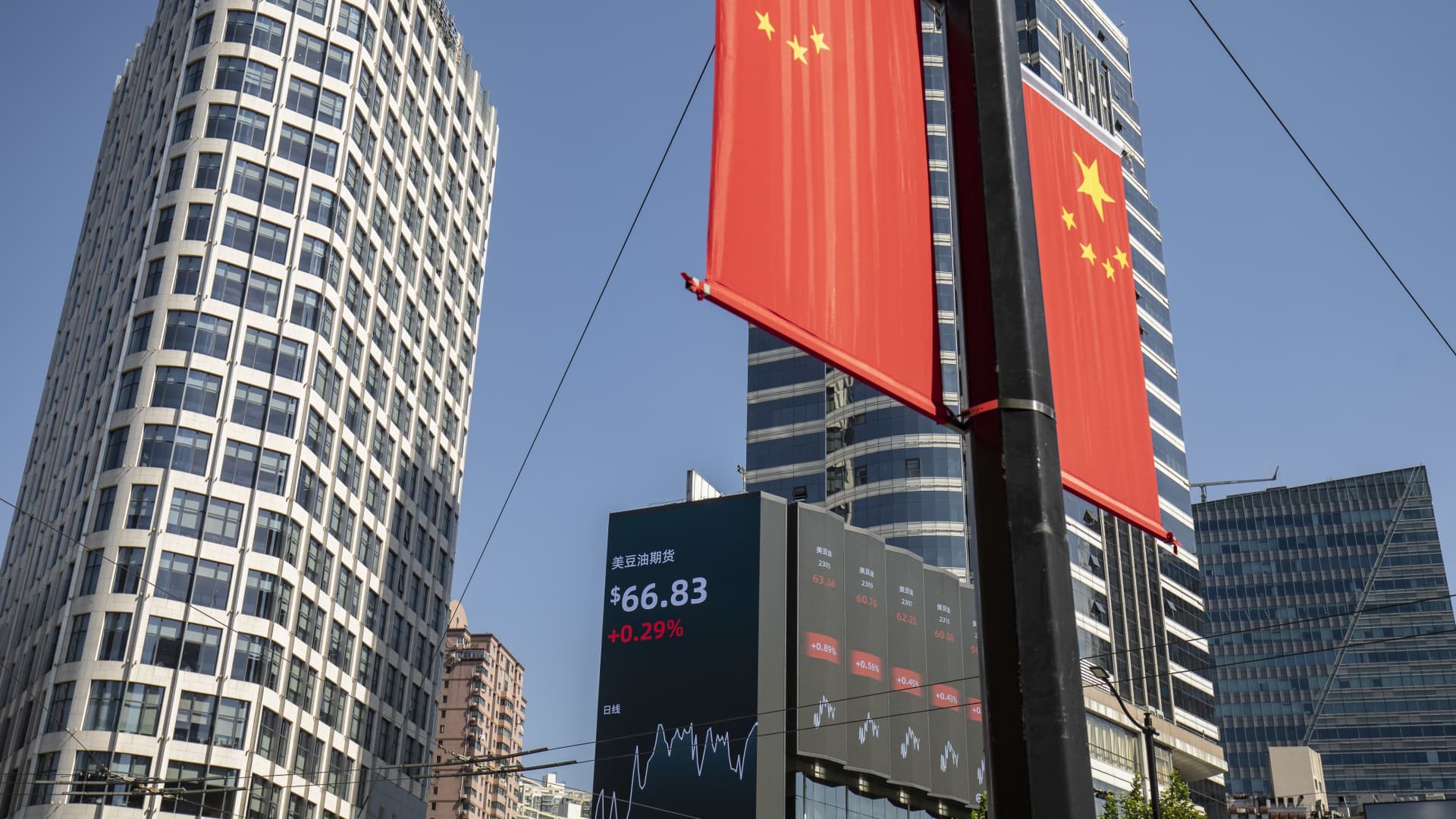

CIARAN RYAN: The year 2023 was miserable for the JSE, with the All Share and Top 40 indices delivering just 3% growth for the year. Compare that with the Nasdaq’s heart-stopping 54% or the S&P 500’s 25%.

The world’s biggest tech stocks, such as Apple and Amazon, accounted for much of that gain. Looking at the difference between the local and offshore returns, you might be gripped by Fomo – fear of missing out – and rush to get your money offshore. But before you do that, let’s get some advice from the experts.

We are joined by Wendy Myers, head of securities at PSG Wealth. Hi, Wendy. Good to speak to you again. When we spoke last year, you mentioned the importance of meeting with your financial advisor to review your portfolio performance and assess whether changes are required to set your portfolio straight for long- and short-term success. Take us through the returns for SA investors, both in the local and offshore markets, and help us understand why we saw such a variance between local and offshore returns last year.

WENDY MYERS: Look, you’re right that the JSE didn’t perform last year. It really is a function of our high interest rates. We know that interest rates inversely impact share price performance, so that’s a point to note. It is very sobering when you look at what the JSE returned performance-wise when compared to offshore and some solid performances from offshore markets. But it’s also important to note that it depends on where you invested offshore.

So, if you look at the FTSE, for example, that delivered only 2.4%, and that’s because that index is quite a commodity-focused index, and the commodity sector really had a tough year in 2023. It continues to have a bit of a tough year going into 2024.

But obviously, if you focus on the US, the S&P delivered magnificent gains, and then the Nasdaq was really driven by the Magnificent Seven [Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla] that you spoke to.

So it really just makes us sit back and say, well, there is a need for investors to have that offshore exposure. And, as much as it can be daunting, I think it’s important for investors to sit down with their financial advisor, like I’m hoping most did at the end of 2023, and look at their portfolio and what their risk parameters are, and see what they can look to invest offshore so that they have the ability to access some of those returns which, I do want to caution, are not necessarily sustainable.

That’s why at PSG we do advocate keeping at least 60% of your investible assets on the local market, because you must remember that we take a very long-term view when looking at equity returns. We don’t just look at what last year did and assume it’s going to carry us forward in the new year.

CIARAN RYAN: A lot of people would take that advice that you’ve given – keeping 60% local – with a pinch of salt because they look at these returns that you get overseas compared to what you get on the local market and they say, no, I want to put more of my money offshore. What do you say to people like that?

WENDY MYERS: Well, I think I can understand that ‘Fomo’ experience. I also think there is such a variety of stocks and ETFs [exchange-traded funds] globally. I think there are even more offshore ETFs than there are actual single counters. So the variety and what’s available is massive – and you can get burnt.

If you look at some of the favourite Covid stocks, these stocks are still trading at 75% below their highs, so investors can lose a lot of money.

And the point around the Nasdaq’s returns is it was only those seven stocks that really delivered. The rest are still lagging.

So I think investors have to be extremely cautious and they need to sit down and say to themselves, I need to have some offshore exposure; what is the best way to do it? Now, there’s the ability to invest directly in your own name; you know how investors can get a million rand offshore per annum [allowance] – which includes your travel allowance without going through the necessary Sars [South African Revenue Service] approval. Or you can apply for a foreign investment allowance annually, anything up to R10 million – this is a process that requires Sars approval.

So exchange control has relaxed to the point where those investors who want to invest offshore have capacity to invest. Then investors have got to look and decide what structure they want to use. So, when you’ve decided on your platform, you need to say, well, do I want to invest offshore in my own name?

Now you must remember that there are certain tax risks, situs being one of them. A lot of advisors will sit down with you and say the best way to gain exposure is to maybe look at endowments that protect South African resident investors from those situs risks.

But certain investors say, well, given my risk profile, I want to have investments in addition to the endowment, and I specifically want to have them in my own name. I want to make sure that the platform that gives me that ability, the structure, is totally offshore. You must remember, Ciaran, there are a lot of dual-listed stocks [that] you can buy on the South African market and still get exposure to overseas markets.

But I think the key point that investors in South Africa must realise is that [with] a lot of the tech stocks which form part of that Magnificent Seven, you only have the ability to invest in those if you invest directly offshore.

CIARAN RYAN: All right. Now, this brings us back to the role of the financial advisor, which we spoke about last year. Just to be clear there – the financial advisor is not there to tell you where and into which stocks you should be investing. Maybe just go over why the financial advisor should get involved in the portfolio decisions.

WENDY MYERS: I think it’s important to remember that they’re experienced, and they’ve got a multitude of research at their fingertips. The financial advisor can assess your risk parameters, your financial needs, where you are from a life-stage perspective, and, with that information, they can guide you as to the best way forward.

I’ve often said financial advisors have their own financial advisors because these guys are very good at taking the emotion out of investing. I think that’s a key point because it keeps investors on a disciplined path to investments. They don’t knee-jerk, which is where I think investors’ emotions drive the buys and the sells, and typically at the wrong times. So [financial advisors guide you in] staying the course. They also guide you in making sure you continue to invest. It’s not a once-off experience.

An advisor is able to look at your portfolio construction and say maybe you are invested in too many tech stocks because you’ve got Fomo, and you want to have exposure to all the Magnificent Seven. But in the context of your total portfolio, it’s too tech-focused.

So they really will make sure that your construction is well suited to weather some short-term shocks, and then can carry you through to deliver on what your ultimate long-term financial goals are.

CIARAN RYAN: And finally, if we look at what’s ahead for 2024, we’ve read a lot about the interest rate cycle easing and what impact that’s going to have on the bond markets and the equity markets. What is your overall advice for people as we head into the new year?

WENDY MYERS: Well, I think the view at this stage is very much that in South Africa the hiking cycle is coming to an end. I don’t foresee that this year we’ll see any rate decreases. It’s a good time to get into the market because prices are depressed. I think the consensus for offshore is that certainly in the US in particular the view is a soft landing, and that the interest rate cycle is also coming to an end. And I think they are even expecting the Fed to start looking at decreasing interest rates – but not aggressively. So I really think that’s why, [for] investors, it’s the time to act now, in my opinion, and have those discussions with your financial advisor.

And if you don’t have one, I think the perfect opportunity is to now look at those exchange-traded funds that give you diversification, that can set you on the path to investment success.

CIARAN RYAN: Just to reiterate, your suggested split in the portfolio is 60% local, 40% offshore. Is that correct?

WENDY MYERS: Very much so. Obviously, that is high-level guidance and it depends on where you are in your journey of investing. You can decide how to tailor it to your unique needs.

CIARAN RYAN: Do you foresee a better year ahead for the JSE?

WENDY MYERS: I really am hoping so; I must be honest with you. I think, as South African investors, we’ve had a tough time of late, so I would love to have a crystal ball and say exactly where it’s going to land.

But all I can tell you is that I do think it’s important for investors to start looking at the JSE and what it can offer you, and start putting money aside into solid stocks that have high dividend payouts, and then start doing a bit of homework about investing offshore in what suits your risk profile – because I really do think that having exposure to equities will set you up for success in the long term to beat inflation because that’s our key thing.

And I think if the JSE comes off quite a depleted base, it certainly can be a key tool for you to achieve your financial goals.

CIARAN RYAN: Indeed. We’re going to leave it there for the moment. Thanks very much, Wendy Myers, head of securities at PSG Wealth.

Brought to you by PSG Wealth.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

#local #market #returns #investors