tzahiV/iStock via Getty Images

From the Crowdstrike (NASDAQ:CRWD) glitch that temporarily crippled operations across multiple industries to former President Donald Trump’s RNC speech that targeted EVs and chipmakers – the market was tested this week.

Many major market indices were in retreat at the end of the five-day trading period. The S&P 500 (SP500) was down -1.97%, posting losses in three out of five sessions and marking the worst weekly performance since mid-April. Nasdaq Composite (COMP:IND) dropped -4.3% in the same period and had its first three-day losing streak since June.

As the market swayed to the events of this week, these were among the top trending stocks:

Trump Media & Technology (NASDAQ:DJT) shares jumped +70% a day after former President Donald Trump survived an attempt on his life at a rally in Pennsylvania on Saturday. Trump, who owns a majority stake in the Truth Social parent company, took the company public earlier this year and shares have since been volatile. By the end of the week, DJT had erased all gains and was down nearly -24%.

Cassava Sciences (NASDAQ:SAVA) shares were hit on Wednesday as both its chief executive and head of neuroscience stepped down from their rolls. Weeks ago, shares had plunged when a Maryland grand jury indicted a company-paid consultant and researcher for falsifying data regarding Cassava’s Alzheimer’s drug, simufilam, to apply for NIH grants. Cassava was down around -13.5% at the end of this week of trade.

Chip stocks slumped on Wednesday and lost nearly $500B in collective market amid a sell-off triggered by reports that the U.S. government may impose further export curb controls on the industry, and Trump’s critical comments against Taiwan’s chipmakers. ASML (NASDAQ:ASML) and Taiwan Semiconductor (NYSE:TSM) were down -17.6% and -12.1%, respectively, for the week. Among other big names, Nvidia (NVDA) dropped -9.8%, AMD (AMD) -17.8%, Qualcomm (QCOM) -8.3%, Intel (INTC) -4.9% and Micron (MU) -14.6%.

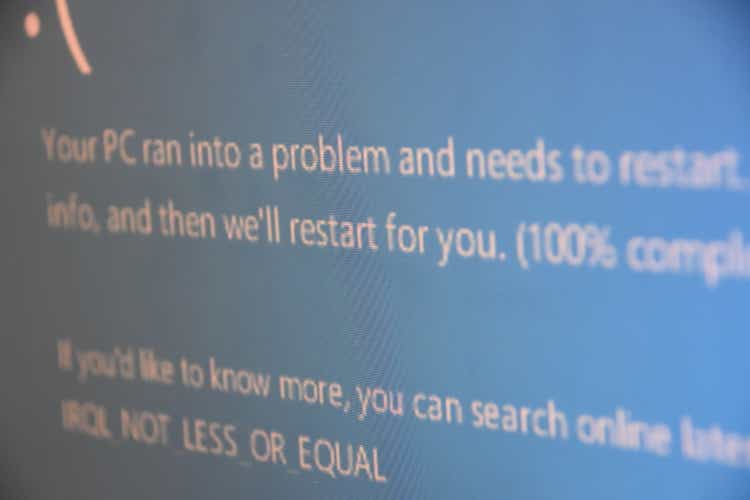

A glitch in an update of CrowdStrike’s (CRWD) Falcon Sensor platform triggered a major outage globally across multiple industry sectors on Friday, including airlines, banks, hospitals and broadcast media. CrowdStrike shares fell nearly -18% in the week and other cybersecurity firms were also in red, including Fortinet (FTNT) -3%, Zscaler (ZS) -7% and Cloudflare (NET) -5.6%. Palo Alto Networks (PANW) recovered some of its losses made over the week, but still closed in red.

Microsoft (MSFT), whose cloud services also faced an outage, dropped -3.6%.

Crypto stocks surged on Monday as Bitcoin (BTC-USD) climbed above $63K following the assassination attempt on Trump, which increased the odds of the former president, a self-proclaimed cryptocurrency advocate, winning the upcoming election. Bitcoin settled on a +2.6% increase at the end of the week. MicroStrategy (MSTR) was up +16.7%, Cipher Mining (CIFR) +25%, Coinbase (COIN) +12.4%, Riot Platforms (RIOT) +16% and Marathon Digital (MARA) +12.7%.

Match Group (MTCH) shares gained around 9% in the week after activist investor Starboard Value revealed a 6.6% stake and pushed for a turnaround or sale, saying that Match’s strong market position is not reflected in its stock price and expressing concerns over declining users at Tinder, the company’s flagship app.

More on this week’s trending stocks:

#Trending #stocks #week #Trump #scares #hit #markets #NASDAQCRWD