The runway toward a Federal Reserve interest-rate cut will come more into focus in the coming week amid fresh signs inflation is abating and economic activity is simmering down.

Article content

(Bloomberg) — The runway toward a Federal Reserve interest-rate cut will come more into focus in the coming week amid fresh signs inflation is abating and economic activity is simmering down.

Economists expect the personal consumption expenditures price index minus food and energy — due on Friday — to have risen 0.1% in June for a second straight month. That would bring three-month annualized core inflation down to the slowest pace this year, and below the Fed’s 2% target.

Advertisement 2

Article content

The report on monthly inflation, part of a reading on personal spending and incomes, will follow the government initial estimate of second-quarter gross domestic product. Forecasters see a 1.9% annualized rate after a 1.4% pace in the first three months of the year.

That would mark that slowest consecutive quarters of economic activity in two years and, combined with moderating job and wage growth, gives Fed policymakers scope to begin easing.

US central bankers next meet on July 30-31, and while the chances of a rate cut then are low, investors see a quarter-point reduction at their September meeting as a virtual lock.

What Bloomberg Economics Says:

“The June PCE inflation data will likely offer encouraging news for the Fed. The monthly pace of core PCE inflation, the Fed’s preferred price gauge, will likely be consistent with the 2% target for a third consecutive print. With the labor market cooling, personal income growth slowing, and consumers becoming more discerning in their spending habits, we think the stage is set for a September rate cut.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, Chris G. Collins, economists. For full analysis, click here

Advertisement 3

Article content

The busy economic data calendar in the coming week includes reports on June sales of new and previously owned homes. Economists project a moderate increase in new-home purchases and a fourth-straight decline in contract closings on existing properties.

The so-called lock-in effect, where homeowners are reluctant to give up their low mortgage rates, has restrained the resale market. That’s been a favorable development for builders, with many offering incentives to goose demand.

The week will also offer a read on demand for big-ticket items. The government’s report on June orders of durable goods is forecast to show tepid bookings for business equipment as high borrowing costs restrain investment.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Looking north, a slim majority of economists in a Bloomberg survey expect the Bank of Canada to cut its key policy rate for a second straight meeting on Wednesday.

Traders put the changes at more than 90% after an inflation report for June showed the headline figure slowed to 2.7% on the year. However, acceleration in a three-month moving average of core price pressures may give some policymakers pause.

Article content

Advertisement 4

Article content

Elsewhere, Group of 20 finance ministers and central bank chiefs will gather for two days of meetings in Brazil, purchasing manager surveys will be released from Japan to the UK, and central banks from Turkey to Russia to Nigeria set rates.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

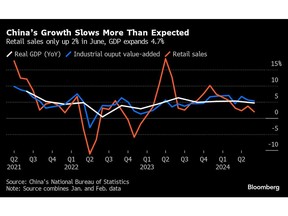

China’s central bank kicks off the week by setting its de facto benchmark lending rates.

The People’s Bank of China is expected to shrug off anemic second-quarter growth data and keep the five-year loan prime rate steady at 3.95% and the one-year at 3.45%.

Industrial profits data on July 26 may show weakness continuing in the private sector in the face of headwinds from the housing slump and soft consumer demand.

Elsewhere, purchasing manager index figures are due in Australia, Japan and India, and inflation data will be published in Singapore, Malaysia, Hong Kong and Tokyo, where a pickup in price growth in July may give Bank of Japan officials a rationale to mull a rate hike when they gather to set policy at the end of the month.

Advertisement 5

Article content

On Tuesday, India’s new coalition government will release its budget for the year, with economists expecting a slight narrowing in the deficit after a revenue windfall.

South Korean gross domestic product data on Thursday is likely to show growth close to a standstill in the second quarter while remaining on track to meet official forecasts for the year.

Trade statistics are due in New Zealand, Hong Kong, South Korea and Thailand.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

Following Thursday’s European Central Bank gathering – when President Christine Lagarde told investors that prospects for the Sept. 12 rate decision remain “wide open” – an unusual eight-week summer break between meetings has started.

Officials may fall largely silent as well, though four are scheduled to make appearances in the coming week. ECB Vice President Luis de Guindos and chief economist Philip Lane speak at a conference they’re hosting in Frankfurt that starts on Tuesday. Bundesbank President Joachim Nagel will speak at the G-20 meeting on Thursday, and Lagarde will participate in an event in Paris the same day to mark the Olympic Games.

Advertisement 6

Article content

Among data releases of note, the ECB’s survey of inflation expectations, due on Friday, may be particularly watched by officials.

Other reports will offer a glimpse into the health of the economy at the start of the second half. Euro-zone consumer confidence will be published on Tuesday, and purchasing manager indexes for the region follow on Wednesday.

The following day, Germany’s closely watched Ifo business confidence gauge may reveal only a small improvement in sentiment in Europe’s biggest economy at a time when its industry is still languishing from an extended slump. An equivalent measure of French manufacturing will also be released on Thursday.

In the UK, Bank of England policymakers will adhere to a quiet period in advance of their Aug. 1 decision, where the prospect of a rate cut looks to be on a knife-edge. PMI gauges will be published there on Wednesday, concurrent with those in the euro area.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Turning to Africa, Ghana’s finance minister, Mohammed Amin Adam, will present the country’s mid-year budget on Tuesday. He’s expected to announce upward revisions to economic growth.

Advertisement 7

Article content

And in South Africa on Wednesday, inflation for June is forecast to slow marginally, to 5.1% from 5.2% the previous month, in part due to lower fuel prices.

Four major central bank decisions are scheduled across the wider region:

- Turkish officials on Tuesday are likely to keep their rate at 50% for a fourth meeting, even as consumer-price growth seems to be finally slowing. Governor Fatih Karahan told Bloomberg this month he wants to ensure he can meet inflation goals beyond this year before discussing rate cuts.

- Also on Tuesday, Hungary is predicted to continue its easing cycle, with economists guessing it will lower borrowing costs to 6.75% from 7%.

- That day will also see a decision in Nigeria, where policymakers are set to raise the key rate for a 12th straight time, to 27.25%, to support the naira and tame prices.

- In Russia on Friday, the central bank is expected to hike its benchmark rate from the current 16% after inflation accelerated in June for the sixth consecutive month. Officials will most likely consider a hike of 100 to 200 basis points, Tass cited Deputy Governor Alexey Zabotkin as saying this month.

Advertisement 8

Article content

Latin America

Latin America’s two largest economies will report mid-July inflation data, which central bankers will scrutinize before rate decisions due days later.

On Wednesday, Mexico publishes consumer-price data for the first half of the month as policymakers navigate the impacts of currency swings sparked by June’s presidential election.

Central bankers have held borrowing costs steady for two straight meetings, though analysts see the chance for a reduction coming at the Aug. 8 gathering.

The next day, Brazil is expected to show inflation remaining well above the 3% target. Central bankers led by Roberto Campos Neto paused their nearly yearlong easing cycle in June, and have given no clear indication of when it could start again as policymakers prepare for their July 31 rate decision.

Additionally, finance ministers and central bankers from G-20 nations will gather in Rio de Janeiro on Thursday and Friday, after deputies hold talks there earlier in the week.

Brazilian President Luiz Inacio Lula da Silva will unveil his plan for an international alliance against hunger on Wednesday, and participants will discuss other topics including a proposal for a global tax on billionaires.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

—With assistance from Laura Dhillon Kane, Brian Fowler, Matthew Malinowski, Monique Vanek, Paul Wallace and Tony Halpin.

Article content

#Downshifting #Inflation #Reassure #Fed