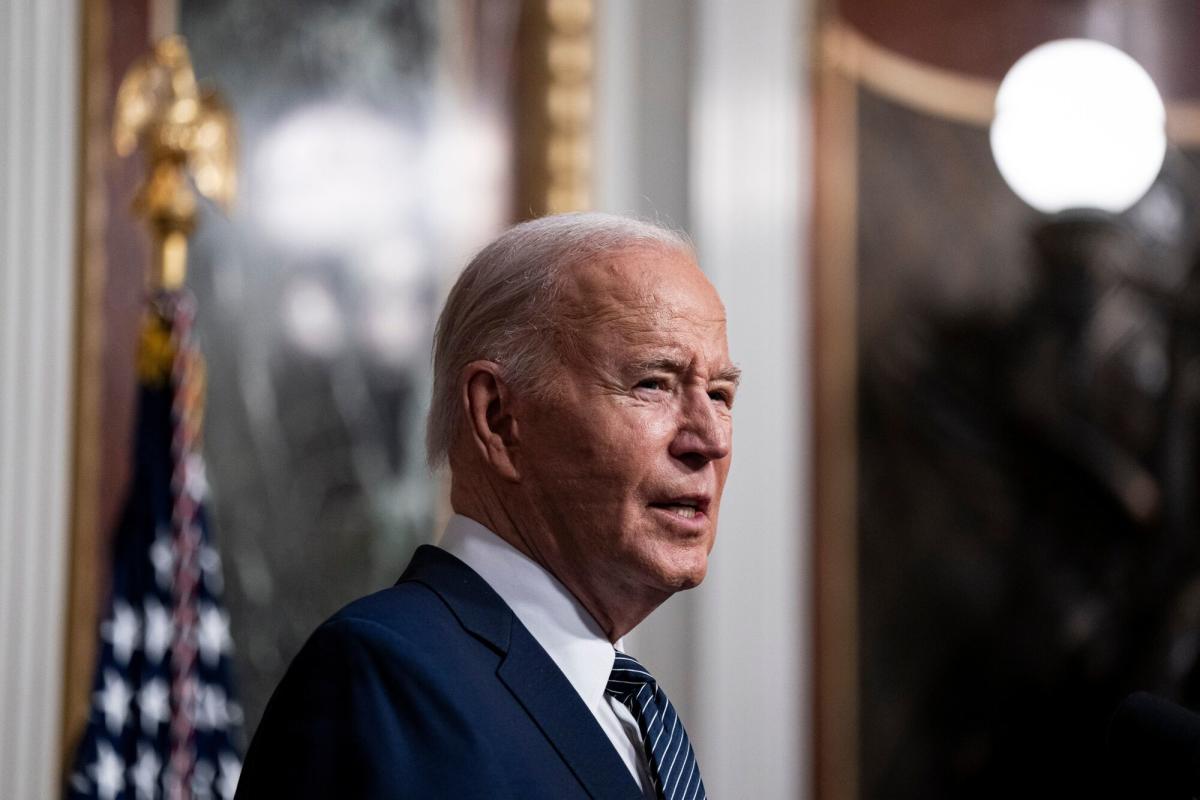

(Bloomberg) — The dollar slipped and Asian stocks fell after Joe Biden ended his reelection campaign and endorsed Vice President Kamala Harris. China’s central bank cut a key short-term interest rate.

Most Read from Bloomberg

A Bloomberg gauge of the US currency’s strength shed 0.1% Monday after the US president bowed to pressure from the Democrats, with the yen and the Swiss franc edging up. The Mexican peso also climbed. US stock futures gained while 10-year Treasury yields slid in Asia.

Stocks dropped from Japan to South Korea and Australia. Futures for Hong Kong equities pointed to a steady open. The People’s Bank of China slashed the borrowing cost for a popular money market loan for the first time in almost a year, stepping up support for growth while shifting toward a new policy benchmark.

Investors have mulled for weeks a greater prospect that Donald Trump will win the November election following Biden’s weak debate performance, only for bets on a Trump win to accelerate last week following an assassination attempt on the Republican candidate a week ago. The question for investors is whether to stick with such trades now that Biden has dropped his bid for reelection.

“Facing bombshell surprises for the second week in a row, the Asian market will be under intense scrutiny,” said Hebe Chen, an analyst at IG Markets. “The accelerated wave of risk aversion could hit Asian stocks harder than the previous week as investors digest the unfamiliar political context. The forex market will also feel the heightened pressure.”

In commodities, oil and gold rose in early trading Monday.

The S&P 500 dropped 0.7% on Friday to cap its worst week since April. Tech shares fell ahead of earnings reports this week, while CrowdStrike Holdings Inc., the firm behind a massive IT failure that grounded flights and disrupted corporations around the world, slumped as much as 15% before paring losses.

Tesla Inc. and Alphabet Inc. will be the first of the “Magnificent Seven” to report earnings on Tuesday. Analysts will likely press Elon Musk’s electric-vehicle giant on the progress of its plans for robotaxis. And investors will delve into the details of Google’s parent revenue boost from artificial intelligence.

Instead, President Xi Jinping at the weekend unveiled sweeping plans to bolster the finances of China’s indebted local governments as the ruling Communist Party announced its long-term blueprint for the world’s second-largest economy. Those are centered around shifting more revenue from the central to local coffers, such as by allowing regional governments to receive a larger share of consumption tax.

“Like most documents of this kind, it did not say how Chinese leaders intended to reach those goals, many of which would require policies that are contradictory in nature,” said Bob Savage, head of markets strategy and insights at BNY Mellon. “The contradiction of China growth vs. stability are hanging over APAC markets and flows, still leaving Chinese yuan and commodities a key focus.”

Investors will watch whether China’s one- and five-year loan prime rates will also move lower later Monday after the PBOC’s decision to reduce the money market rate.

Elsewhere this week, traders will be focused on economic activity data in Europe, US second quarter growth and a slew of corporate earnings. The Bank of Canada will give a rate decision while the Federal Reserve’s preferred measure of inflation is also due.

Key events this week:

China loan prime rates, Monday

Hong Kong CPI, Monday

Taiwan jobless rate, export orders, Monday

Mexico retail sales, Monday

Israeli Prime Minister Benjamin Netanyahu embarks on visit to Washington, Monday

EU foreign ministers meet in Brussels, Monday

Singapore CPI, Tuesday

Taiwan industrial production, Tuesday

India’s budget for fiscal year through March 2025, Tuesday

Turkey rate decision, Tuesday

Eurozone consumer confidence, Tuesday

Alphabet, Tesla, LVMH earnings, Tuesday

Malaysia CPI, Wednesday

South Africa CPI, Wednesday

Eurozone HCOB PMI, Wednesday

UK S&P Global PMI, Wednesday

Canada rate decision, Wednesday

IBM, Deutsche Bank earnings, Wednesday

ECB Vice President Luis de Guindos speaks, Wednesday

Hong Kong trade, Thursday

South Korea GDP, Thursday

US GDP, initial jobless claims, durable goods, merchandise trade, Thursday

G-20 finance ministers and central bankers meet in Rio de Janeiro, Thursday through Friday

Bitcoin 2024 conference in Nashville, Thursday through July 27

Japan Tokyo CPI, Friday

US personal income, PCE price index, University of Michigan consumer sentiment, Friday

Mexico trade, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.3% as of 9:30 a.m. Tokyo time

Hang Seng futures were little changed

Japan’s Topix fell 0.8%

Australia’s S&P/ASX 200 fell 0.7%

Euro Stoxx 50 futures fell 1.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.1% to $1.0894

The Japanese yen was little changed at 157.42 per dollar

The offshore yuan was little changed at 7.2889 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $68,229.85

Ether rose 1.1% to $3,537.95

Bonds

Commodities

West Texas Intermediate crude rose 0.5% to $80.55 a barrel

Spot gold rose 0.3% to $2,409.20 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Joanna Ossinger, Richard Henderson, Matthew Burgess, Ruth Carson and Winnie Zhu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

#Dollar #Asian #Shares #Drop #Biden #Election #Exit #Markets #Wrap