champc

With inflation pressures hitting all the major indices, real estate stocks suffered a slight loss this week.

With inflation staying sticky, traders are reducing bets on a rate cut in May.

“There’s a meaningful chance — maybe it’s 15% — that the [Federal Reserve’s] next move is going to be upwards in rates, not downwards,” former Treasury Secretary Lawrence Summers said in an interview on Friday, citing a number of “disturbing” inflation pressures.

The Dow Jones Industrial Average Index closed at 38,627.99 on Friday, 0.11% down from a week ago, while NASDAQ Composite Index was down 1.34% to 15,775.65.

S&P 500 fell by 0.42% W/W to close at 5,005.57, when the index had gained ~5% from the beginning of 2024.

XLRE, which tracks S&P 500 real estate stocks, declined by 0.15% from last week to close at 38.35. The index is down 4.27% YTD.

The ETF saw net inflows of $147.22M this week, as compared to outflows of $13.06M in the previous week, data from the data solutions provider VettaFi showed.

Brixmor Property Group (BRX), Safehold (SAFE), Zillow Group (Z)(ZG), STAG Industrial (STAG), Blackstone Mortgage Trust (BXMT), Chimera Investment (CIM) and Opendoor Technologies (OPEN) were the notable earnings winners of the week.

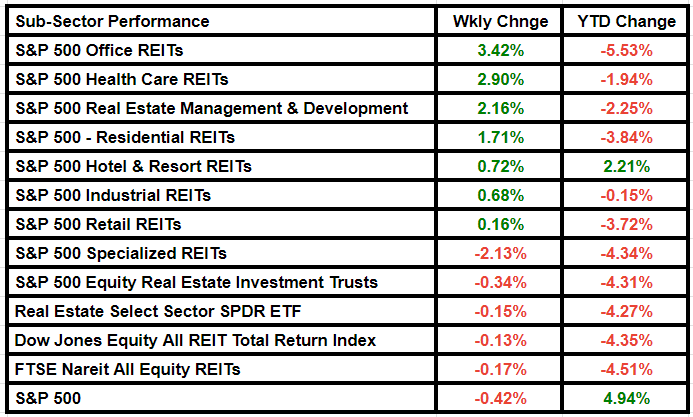

Among subsectors, Office and Health Care gained the most. Here is a look at the subsector performance:

More on Real Estate:

#Real #estate #slightly #inflation #pressures #hit #major #indices #NYSEARCAXLRE