Chinnapong/iStock Editorial via Getty Images

Bitcoin (BTC-USD) is on track to post a weekly gain of ~11%, its highest levels in almost a month, amid renewed concerns over the health of regional banks.

New York Community Bancorp is seeking to offload risk related to a large portfolio of residential mortgages and add liquidity at its Flagstar Bank unit.

“The conversations around a banking crisis and positive government data around inflation have been key drivers for the surge,” said Dan Raju, CEO of brokerage Tradier.

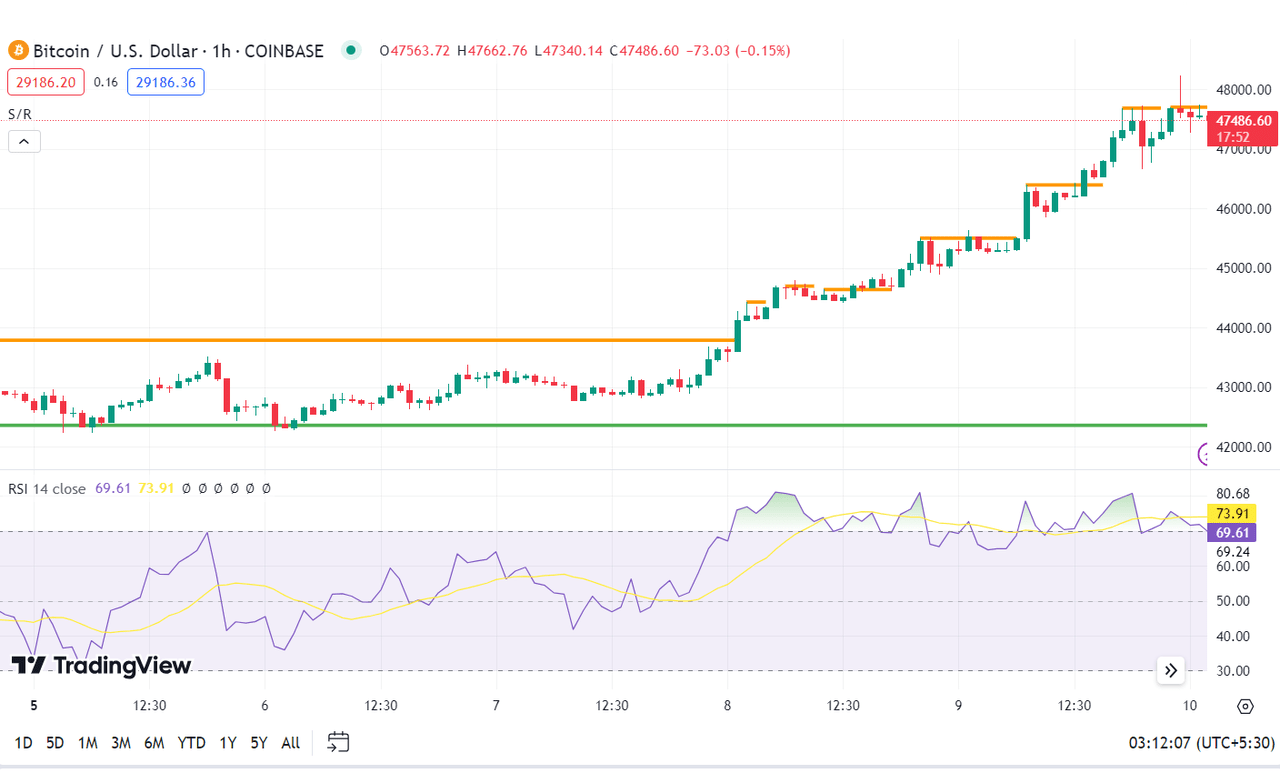

Bitcoin (BTC-USD) broke the $48K mark on Friday for the first time in a month, which also pushed cryptocurrency-linked stocks higher. While the top crypto had seen lukewarm trading last week, it picked up in the week ending Feb. 9 and traded in the range of $42K-$48K.

Spot Bitcoin (BTC-USD) ETFs also saw consistent inflows, seeing their third-largest influx of $403 million on Feb. 8, Coin Telegraph reported. The ETFs’ total inflows have already exceeded $2.1 billion since their launch last month.

“This time, Bitcoin’s (BTC-USD) price action looks stronger pre-halving, and in our view, will likely sustain momentum for the rest of the year,” said Bernstein analyst Gautam Chhugani. He recommended buying crypto mining stocks, with his top picks being Riot Platforms (RIOT) and CleanSpark (CLSK).

Notable News

- Crypto custody and trading platform Bakkt (BKKT) on Thursday said there’s “substantial doubt” about its ability to continue as a going concern in the next year without raising capital.

- CleanSpark (CLSK) on Thursday posted an unexpected quarterly profit, as its Bitcoin (BTC-USD) mining revenue surged 166% from a year before, thanks to a rally in BTC prices.

- Crypto exchange Binance will delist the monero (XMR-USD) privacy coin on Feb. 20, sending the token down 28.2% on Tuesday. It also plans to delist aragon (ANT-USD), multichain (MULTI-USD) and vai (VAI-USD) tokens.

- Former President Donald Trump, who personally owns investments in crypto, said central bank digital currencies (CBDCs) can be a “very dangerous thing.”

- Bitcoin (BTC-USD) miners reported their Jan. production this week, with the output of Marathon Digital (MARA) down 42% M/M, Riot (RIOT) down 16% M/M, CleanSpark (CLSK) down 19.86% M/M, and Argo Blockchain (OTCPK:ARBKF) down 20% M/M.

Bitcoin, Ether Prices

Bitcoin (BTC-USD) rose ~4.26% to $47.4K at 4:36 pm ET on Friday, and ether (ETH-USD) inched up ~2.50% to $2.5K.

SA contributor WisdomTree believes there are multiple signals, one being volatility, that show Bitcoin (BTC-USD) is maturing as an asset class.

“The fact that spot Bitcoin (BTC-USD) exposure is available in the ETF structure was an important milestone, but it was just one among an array of signals that indicate Bitcoin as an asset class is on its journey toward maturation.”

More on cryptocurrencies

#Bitcoin #set #gain #week #crossing #48K #time #ETF #rally