(Bloomberg) — Federal Reserve policymakers may finally be right on the verge of cutting interest rates.

Most Read from Bloomberg

Going into this week’s two-day policy meeting, which wraps Wednesday afternoon in Washington, investors are assigning roughly even odds to the prospect that the US central bank will start lowering borrowing costs at its next decision in March.

That makes Fed Chair Jerome Powell’s press conference, and any signal he may or may not choose to send, of critical importance. It all comes down to how Powell and his colleagues have been reading the recent spate of economic data.

On one hand, inflation numbers continue to surprise to the downside. The Fed’s preferred gauge decelerated to 2.9% in December, crossing below 3% for the first time since early 2021, according to data published Friday.

On the other, consumer spending continues to be surprisingly robust. It’s undoubtedly getting a boost from the downdraft in inflation, but the strength still may keep some worried that price pressures could mount once again.

What Bloomberg Economics Says:

“The stage is set for the Fed to take steps toward cutting rates in coming months. We expect the Fed to begin lowering the federal funds rate target range in March as it attempts to stick a soft landing.”

—Stuart Paul and Estelle Ou.

Fed decision aside, we’ll get more US data in the week ahead. Most important will be the monthly jobs report on Friday. Job openings and consumer confidence data on Tuesday — and a quarterly employment cost index release on Wednesday, during the Fed meeting — will also help inform how strong the outlook for spending really is.

Turning north, Statistics Canada releases gross domestic product data by industry for November, after three consecutive months of flat growth. The economy would be shrinking, if not for a massive population surge led by uncontrolled temporary migration.

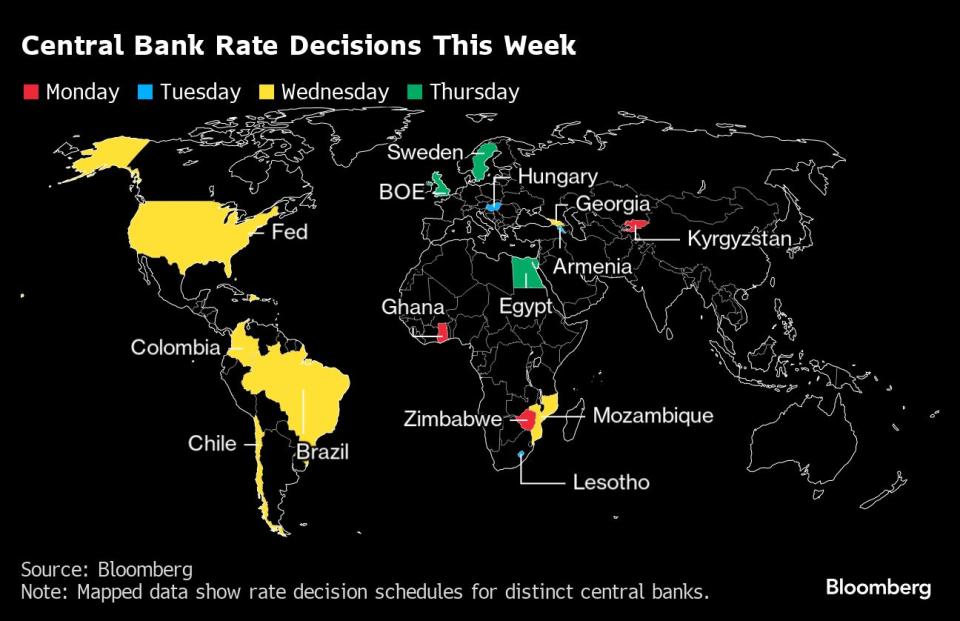

Elsewhere, central bank decisions in the UK and Sweden may keep rates on hold while three Latin American central banks are set to cut.

Euro-zone inflation and GDP data, and Chinese business surveys will also focus investors, and the International Monetary Fund published new forecasts on Tuesday.

Asia

China releases purchasing manager indexes on Wednesday that will shed light on the current state of the world’s second-largest economy.

Both the manufacturing and service sectors have weakened since September, with falls in factory activity deepening amid continued chatter over the need for more stimulus to support sputtering growth.

The official readings will be followed by private sector PMI reports for China and the corresponding figures for other countries in a region that has shown sluggish activity levels, partly due to their giant neighbor’s lack of zip.

The week kicks off with the first decision by the Monetary Authority of Singapore since it switched to quarterly meetings and long-running chief Ravi Menon departed.

A summary of opinions from Bank of Japan board members at its January gathering will offer further clues to how close the central bank is to its first rate hike since 2007. March or April are seen as very much live meetings.

The Philippines, Taiwan and Hong Kong release economic growth results for the fourth quarter during the week.

Australia’s quarterly inflation figures are due Wednesday with a further cooling expected just a few days before the central bank decides policy at its first meeting of the year.

South Korean trade figures offering a pulse check on global trade, and inflation data round out the week.

Europe, Middle East, Africa

Three central bank decisions will draw attention in Europe:

The Bank of England could step back from its threat to raise rates again if needed after UK wage growth cooled at one of the fastest paces on record. There’s reason for caution though, not least after data showed an unexpected pickup in inflation last month. That’s on Thursday.

Riksbank officials have already indicated that it won’t be necessary to lift borrowing costs again, but their decision the same day could reveal how determined they are to keep rates high for now.

In Hungary on Tuesday, policymakers could follow through with another reduction in borrowing costs. Most economists are anticipating a 100 basis-point move down to 9.75%.

The week is also significant for data, with countries across the European Union set to release both growth and inflation numbers.

Belgium and Sweden will publish such reports on Monday, followed the next day by several countries including Germany, France, Italy and Spain.

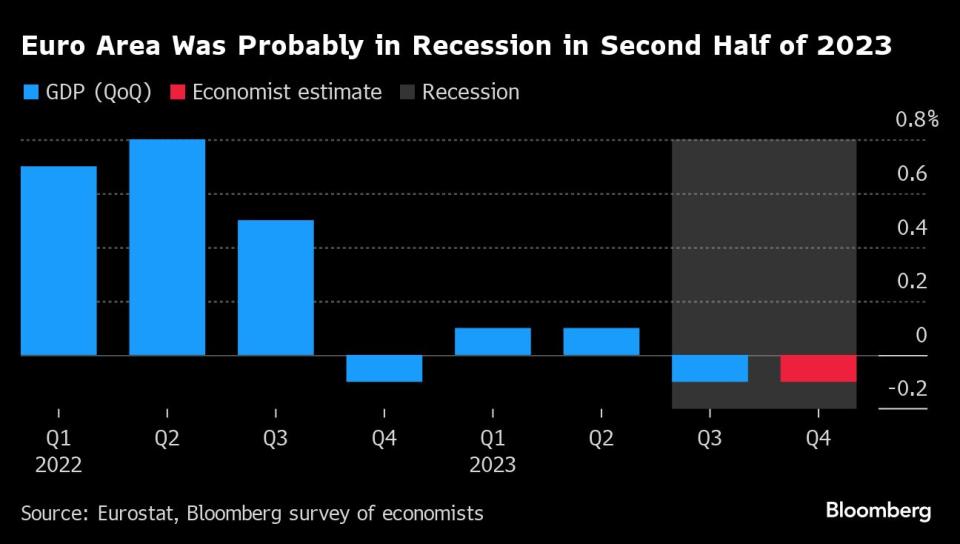

For the euro zone, economists anticipate the outcome to be a second quarterly contraction of 0.1% — meeting the typical definition of a recession.

Inflation reports from around the region are also due, culminating in the result for the currency zone as a whole on Thursday.

A reading of 2.7% is expected there — still noticeably above the European Central Bank’s target — while the so-called core gauge that strips out energy and such volatile elements may remain even higher.

Beyond Europe, several other central banks will make announcements too:

The Bank of Ghana’s decision on Monday is a close call on a possible cut. Inflation is continuing to slow, making its real rates among the world’s highest. Even so, the IMF has cautioned against loosening.

The same day, Zimbabwe could explain its plans to handle a rout in the currency, which is down more than a third against the dollar on the official market so far this year.

Lesotho which has its currency pegged to South Africa’s rand, may follow its neighbor on Tuesday and hold its key rate at 7.75% to support its economy.

On Wednesday, Mozambique is likely to keep borrowing costs unchanged to contain inflation even after the IMF said it has room to cut.

Egyptian officials will meet the next day amid the worst economic crisis in decades, with investors ultimately anticipating a devaluation. While talks with the IMF continue, the central bank may still keep its rate at 19.25%.

Among data highlights, data on Wednesday may show Saudi Arabia’s economy shrank for a second straight quarter at the end of 2023 after a contraction that mostly reflected a cut in oil production to push up prices. That’s turned it from one of the Group of 20’s fastest-growing members to one of its laggards.

Latin America

Banco Central do Brasil has telegraphed delivery of a fifth straight half-point rate cut Wednesday to 11.25% and a sixth lined up for the March meeting.

Analysts surveyed by the bank see 9% by year-end but little leeway thereafter given sticky inflation expectations.

Brazil also reports out December year-end industrial production and national unemployment.

Colombia’s central bank is also all but certain to cut for a second straight month though analysts differ over the size of the reduction. A lower-than-expected December inflation reading my persuade the bank to go for a half-point trim to 12.5%.

Banco Central de Chile has far more room for maneuver and may vote for a 100 basis-point move lower to 7.25%. Economists surveyed by the bank see inflation back to the 3% target this year.

On the inflation front, data for Lima, Peru’s megacity capital, may show that consumer price increases picked up from December’s 3.24% reading. Brazil reports out its less-closely watched IGP-M price index, the country’s broadest measure of inflation.

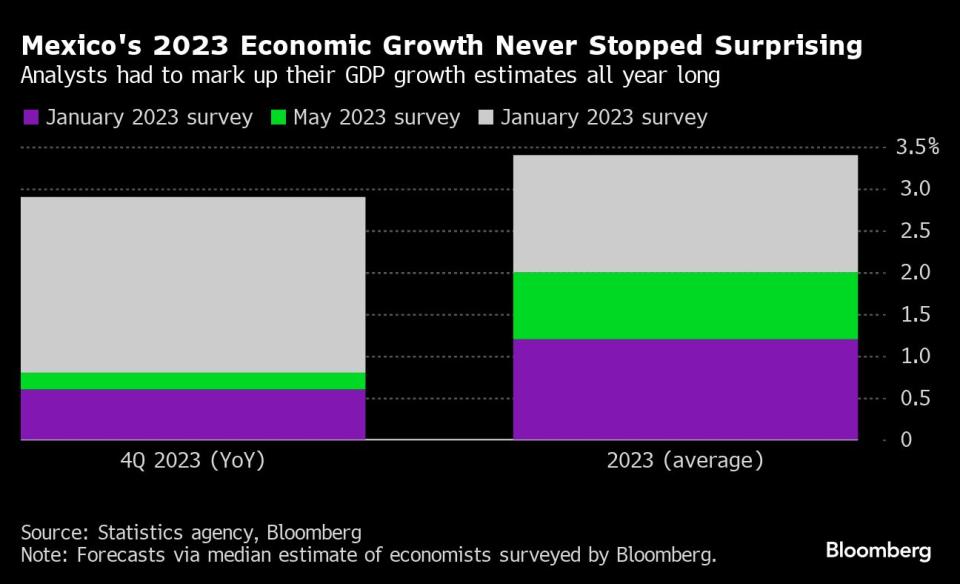

Rounding out the week, Mexico’s flash reading on fourth-quarter output should show a quarter-on-quarter downshift from the 1.1% pace seen in the three months through September, slowed by more than a year of double-digit borrowing costs.

—With assistance from Robert Jameson, Piotr Skolimowski, Laura Dhillon Kane, Paul Jackson and Monique Vanek.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

#Fed #rate #decision #prelude #March #cut