Federal Reserve Bank of Chicago President Austan Goolsbee said that while recent data give him hope that inflation can cool without too much pain in the economy, he’d like to see more of a trend develop before the central bank stops raising interest rates.

![pliyau0]vj5b7v19fs480diy_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/08/inflation-in-us-decelerates-by-more-than-forecast-consumer-.jpg?quality=90&strip=all&w=288&h=216&sig=mYn4D1IAR7cFiqldq1jCtA)

Article content

(Bloomberg) — Federal Reserve Bank of Chicago President Austan Goolsbee said that while recent data give him hope that inflation can cool without too much pain in the economy, he’d like to see more of a trend develop before the central bank stops raising interest rates.

Advertisement 2

Article content

“We have seen progress for a short period before, like last summer, and that proved to be false improvements,” Goolsbee said Tuesday in an interview, adding that it was too soon to say what the Fed should at its next policy meeting in September.

Article content

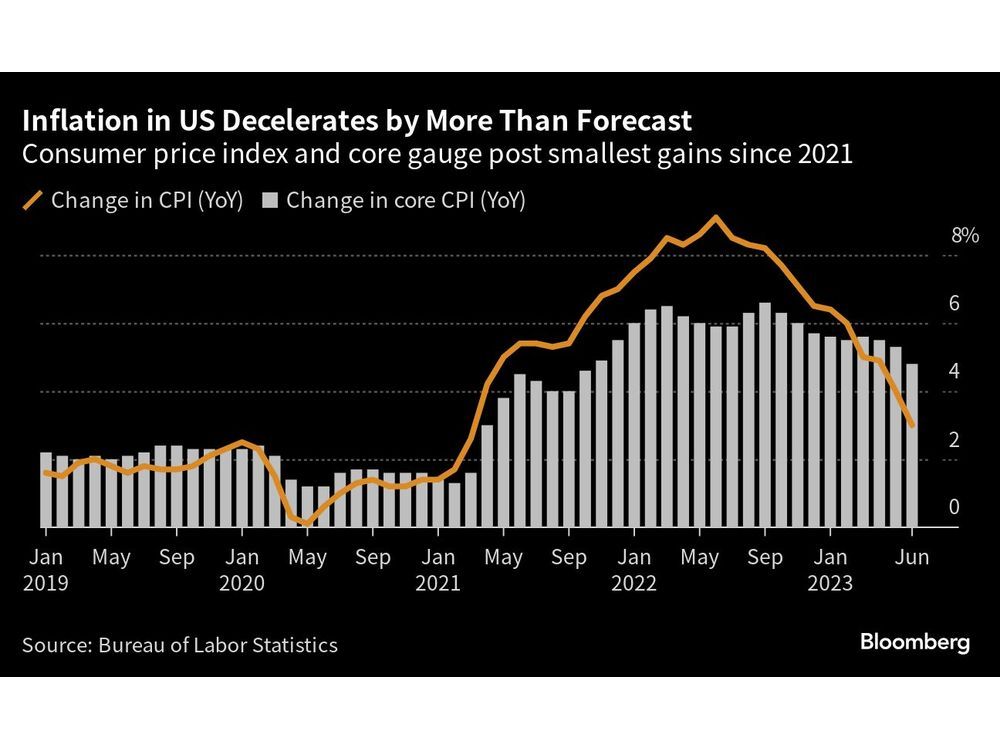

Officials have slowed the pace of rate increases, following aggressive action to tame an annual inflation rate that reached a 40-year high last year, but delivered a quarter-point increase at their July meeting. Policymakers are looking for signs that price growth is on a steady downward trajectory before halting rate hikes.

Two reports released last month showed a cool-down in price growth, especially in components of inflation that hadn’t shown much progress in the past few months. But one or two good reports are likely not enough to placate officials, who were spooked when inflation slowed down during the early months of summer last year only to accelerate again in August and September.

Article content

Advertisement 3

Article content

“I don’t like pre-committing what are we going to do in September,” the Chicago Fed chief said. “When you’re around the transition point, every meeting is a live meeting and you’re trying to figure out trends, not just reflect one month’s data.”

A voter on monetary policy this year, Goolsbee supported the Fed’s decision to raise rates to a range of 5.25% to 5.5% at the July 25-26 meeting, following a pause in June. The central bank has raised rates by 5.25 percentage points since March of 2022, including four jumbo-sized 75 basis-point hikes last year.

Key to his outlook, Goolsbee said, is how core goods inflation evolves. That category includes everything from used cars — which had been a significant driver of inflation — to clothes and furniture. Before the pandemic, it was a drag on overall prices, but the buying frenzy during lockdowns — and subsequent supply-chain issues — drove up these costs substantially.

Advertisement 4

Article content

“Core goods going back to deflation is critical in the near term,” Goolsbee said.

He’s also looking at housing inflation, which has slowed down a bit in the last few months and is expected to decelerate more substantially later this year and into 2024.

Some Fed officials, including Chair Jerome Powell, have said they’re closely watching prices in services excluding food, energy and housing as a bellwether for wages.

Lagging Indicator

Goolsbee has said he doesn’t think of wages as a predictor of inflation, but rather as a lagging indicator: First prices rise and then wages — whose increases tend to be much stickier — react later. If Fed officials peg policy too much to wages, they could risk overshooting interest rates.

Advertisement 5

Article content

When it comes to inflation in core services minus housing, Fed officials “always knew it was stickier,” Goolsbee said. The surprise is that goods inflation didn’t slow as quickly as the Fed forecast it might.

Watching how core goods and housing inflation evolve will be key to help keep the Fed on what Goolsbee calls the “golden path” of bringing down prices without causing a recession.

“Those are the two components that over the next three to six months, let’s call it, if we are to succeed to stay on the golden path, we’ve got to see progress on those two parts of inflation,” he said. “We don’t yet have to see progress on services inflation.”

Goolsbee cautioned against making too many comparisons to prior periods of high rates of inflation — which some economists do to reason that the Fed won’t be able to bring down inflation without significant job losses — arguing that today’s conditions are extremely different.

“I’m guardedly optimistic that we can stick on the golden path,” he said. “Because the business cycle was so different from Covid than previous business cycles, and the recovery has looked nothing like previous recoveries. There are lessons from past business cycles but they’re limited — they’re cousins but not siblings.”

Article content

#Feds #Goolsbee #InflationEasing #DataBefore #September #Rate #Decision

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation